The amount of overhead incurred is not the same as the amount expected. Hence a certain amount of overhead is therefore applied to a given department such as marketing.

Income Statement Template Free Layout Format Statement Template Income Statement Profit And Loss Statement

Round answers to the nearest whole dollar.

Over under applied overhead formula. We know that overhead is underapplied because the applied overhead is lower than the actual overhead. Total manufacturing overhead applied. AO R T.

For example if there is 100000 of standard overhead to be applied and 2000 hours of direct labor expected to be incurred in the period then the overhead. Under-absorbed Overheads Rs13000 1181250 Rs1185750. The preset formula for overhead application estimated that 41500 would be incurred and 4000 direct labor hours would be worked.

The under-applied overhead has been calculated below. Notice that the formula of predetermined overhead rate is entirely based on estimates. Applied overhead is usually allocated out to various departments according to a specific formula.

Use this information to determine the amount of factory overhead that was over or under applied. Direct costs are associated with units produced and sales and administrative are office expenses and hence have to be ignored during computation of factory overhead. It is the difference between the manufacturing overhead cost applied as the job progresses and the actual manufacturing overhead cost during a designated accounting period.

Overhead is overapplied when more overhead is applied to the jobs than was actually incurred. The following formula is used to calculate an applied overhead. Overhead is underapplied when not all of the costs accumulated in the manufacturing overhead account are applied during the year.

Over or under-applied manufacturing overhead means the indirect costs that are targeted to make a product. To apply overhead we will use the actual amount of the base or level of activity x the predetermined overhead rate. ProfAlldredge This video shows a basic way of disposing of over- or under-allocated overhead at the end of the periodFor best viewing switch to 1080p.

Notice how the predetermined rate is based on ESTIMATED overhead and the ESTIMATED base or level of activity. Actual amount of base x POHR. 800 per direct labor hour.

Multiply the 150000 by each of the percentages. For example the standard allocation rate might be designed to allocate 200000 of factory overhead to units of production and there is an under-application of 25000. The basis upon which overhead is applied is in an amount different than expected.

It is to be noted that under or over-absorption may arise from either actual overheads differing from budget or a difference between the actual and budgeted amount of the absorption. The overhead applied to products or job orders would therefore be different from the actual overhead. During March 4250 hours were actually worked.

Overapplied overhead happens when the estimated overhead that was allocated to jobs during the period is actually more than the actual overhead costs that were incurred during the production process. Applied overhead is a measure of the total cost of labor and overhead when a labor rate is applied to a total time of production. There can be several reasons for overhead under absorption or over absorption including.

This implies that the actual cost incurred was 225000 rather than. The amount of overhead overapplied or underapplied is adjusted into the cost of goods sold account. Not enough overhead has been applied to the accounts.

Therefore the calculation of manufacturing overhead is as follows 7141500 14283000 10712250 714150 33213100. Actual total manufacturing overhead cost Total manufacturing overhead applied Under-applied over-applied overhead. Actual overhead was 9800 from indirect materials 1000 indirect labor of 2000 and other overhead of 6800.

Manufacturing Overhead will be. Under-applied manufacturing overhead Total manufacturing overhead cost actually incurred Total manufacturing overhead applied to work in process. Underapplied overhead indicates that the actual amount of factory overhead incurred was greater than expected.

Again to apply overhead use this formula. In a sense the production managers came in under budget and achieved a lower overhead than the cost accountants estimated. Subtract the budgeted overhead costs from the actual overhead costs to determine the applied overhead.

For example the actual overhead rate for a company is 10 an hour Therefore actual overhead is 10000 by the equation 10 x 1000 hours. 1300000 1450000 150000 underapplied. Reasons for Overhead Under Absorption and Over Absorption.

Predetermined overhead rate 8000 1000 hours. Now calculate the variance. In our example 10000 minus 8000 equals 2000 of underapplied overhead.

In our example manufacturing overhead is under-applied because actual overhead is more than applied overhead. At the end of the period. Where AO is the applied overhead R is the allocation rate hr T is the total time of production hr Applied Overhead Definition.

If we compare applied overhead 9850 and actual overhead 9800 we see a difference of 50 over-applied since the applied amount is greater than the actual overhead. The term underapplied overhead refers to a situation that arises when overhead expenses amount to more than what a company actually budgets for in order to run its operations.

Calculator For Slope And Deflection Of Cantilever Civil Engineering Software Civil Engineering Online Calculator

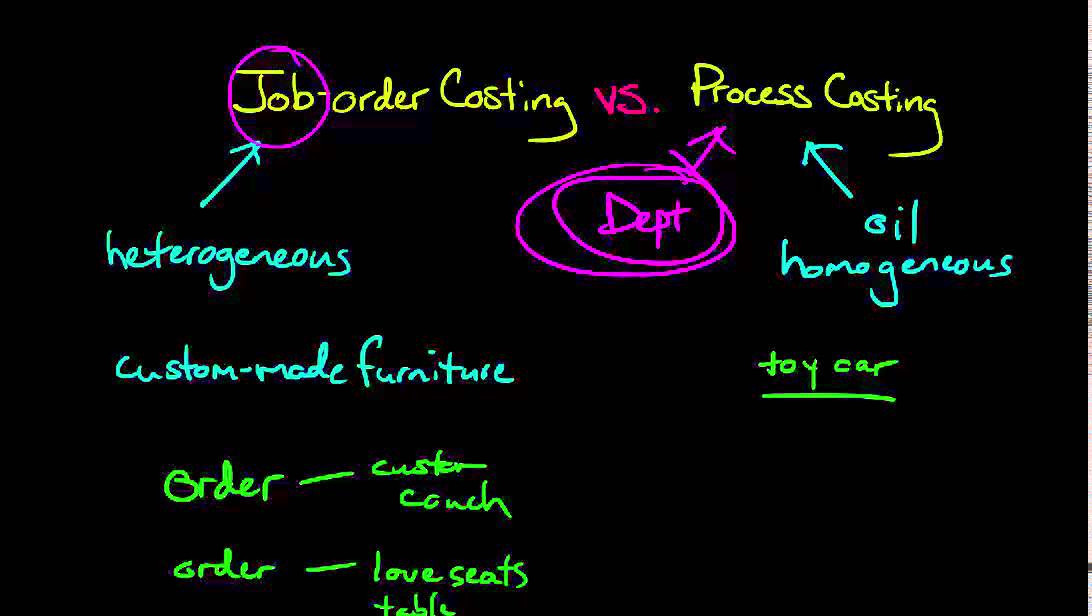

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Proces Job Relatable Managerial Accounting

Describes Job Order Costing Managerial Accounting Accounting Basics Information And Communications Technology

These Garage Door Openers Make For Secure Parking In 2021 Garage Door Opener Best Garage Doors Smart Garage Door Opener

Organizational Structures Advantages And Disadvantages In 2021 Organizational Structure Organizational Career Path