Over or Under Absorption Of Overheads. A credit balancingamount is an over-absorption and a debit balancing amount is anunder-absorption.

Absorption Costing Absorption Of Overheads Formula Mindmaplab

In either case the amount of expenses actually incurred and the amount of overheads applied to production will seldom be the same.

Over absorption and under absorption of production overheads. When the amount absorbed is less than the actual overhead there is under-absorption. Such over or under-absorption may also be termed as overhead variance the amount of over-absorption being represented by the credit balance on the variance account and conversely the amount of under- absorption. This is a balancing figure and is transferred tothe Overunder-absorption of overheads account.

If overhead is under absorbed this means that more actual overhead costs were incurred than expected with the difference being charged to expense as incurred. Hi SAP Gurus Request for your help to resolve my following queries. Overhead expenses are usually applied to production on the basis of predetermined rates.

Overunder absorption of overheads. An over absorption arises where the absorbed overheads are more than the actual overheads incurred. Under-absorption of overheads means that the amount of overheads absorbed in the production is less than the amount of actual overheads-Incurred.

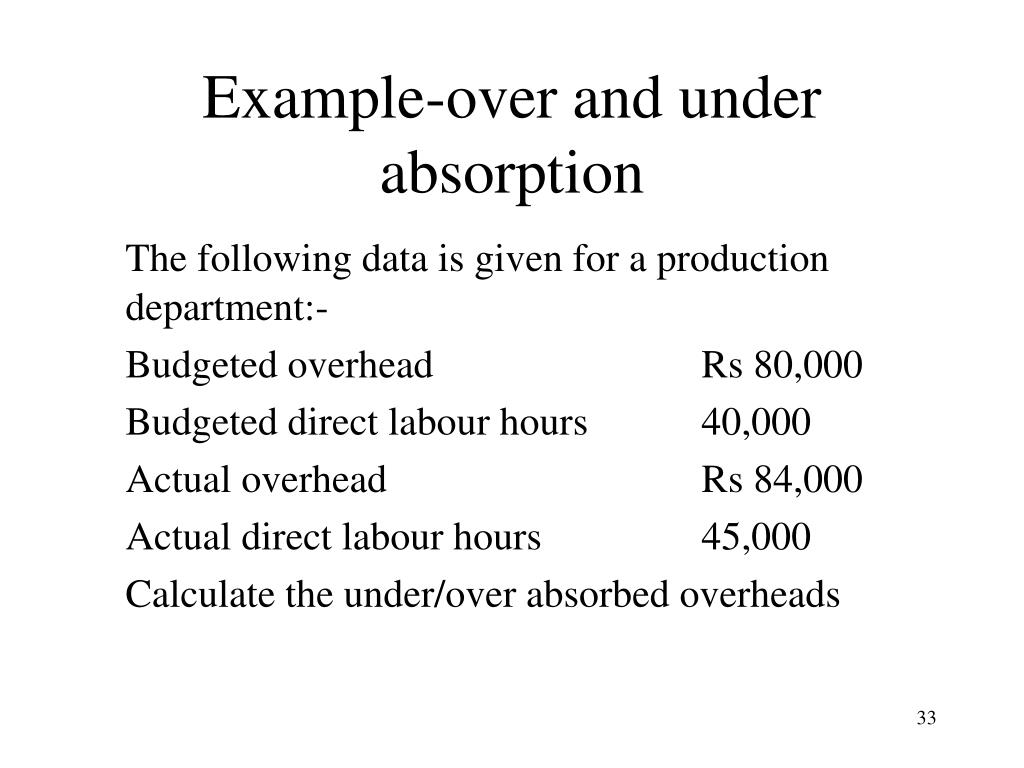

Treatment of Over or Under Absorption of Overheads. 5 machine per hour Actual machine hours 1500 Actual overhead Rs. How is question A different to Question B.

The use of a predetermined rate may therefore result in under-absorption or over-absorption. One of the causes may be overestimation of overheads used to calculate the absorption rate. The other cause may be to under estimate the activity level or units of the cost driver at a given level of overhead.

The term under absorption of overhead means that the amount of overhead absorption is lessthan the actual overhead incurred is said to be under absorption of overhead. Under absorption is an expense and will be transferred to the profit or loss account at period end either through the overunder absorption account or directly from overheads control account increasing the expenses and decreasing profit. Tracking income and expenditure regularly as part of the process of monitoring and controlling budgets is one of the primary purposes of standard costing.

Absorbed overheads 190000 x 250hour 475000 Actual overheads 485000 Under-absorption 10000. Also we calculate the overhead in costing sheet with plan rates. In the case of under absorption the overheads is adjusted by a plus rate since the amount is to be added whereas over absorption is adjusted by a minus rate since the amount is to be deducted.

1 00000 and the actual overheads incurred are Rs. Under and over absorption of Overheads with example Cost Accounting Mathur Sir ClassesMathurSirClasses StudyMaterialPlease SUBSCRIBE for more videosMu. We calculate plan activity rates execute a costing run.

The difference between the absorbed and actual overheads incurred gives rise to an over or under absorption of overheads. There may be over or under absorption of overhead due to over- or under utilisation of productive capacity. I used the same approach in both.

The under- or over-absorbed fixed production overheads for the year were. Since predetermined overhead rates are based on budgeted overheads and budgeted production invariably the overheads absorbed by this process do not agree with the actual overheads incurred for the period. The question of dealing with the over-recovery or under-recovery of expenses can be dealt with only with reference to the cause leading to over- or under-absorption.

1 20000 there is under-absorption to the extent of Rs20 000. Actual overheads incurred during a period possibly be either greater than or less than overheads absorbed into the cost of production and so it is almost inescapable that at the completion of the accounting year there will have been an over absorption or under absorption of the overhead actually incurred. The term over absorption means that the amount of overhead absorption is more than theactual overhead is said to be over absorption of overhead.

Explore over and under absorption of fixed overheads using variance analysis with our AAT tutor. OVER-absorption occurs when the total overhead recovered or absorbed is GREATER than the actual level of overheads for the period. 4 At the end of an accounting periodthe balance on the overunder-absorption account is transferred to theincome statement where it is written off under-absorbed overhead orincreases profit over.

Methods for the Treatment of UnderOver Absorption. Definition of Over-Absorption and Under-Absorption of Overheads. For example if the overheads absorbed on a predetermined basis are Rs.

If the actual amount of overhead turns out to be different from the standard amount of overhead then the overhead is said to be either under absorbed or over absorbed. Over absorption arises when the amount absorbed is more than the actual overhead. The over or under absorption is the balance on the control account and may be posted to an overunder absorption account.

Try entering the overheads. Usually overheads are absorbed on the basis of predetermined rates. UNDER-absorption occurs when the total overheads recovered or absorbed is LESS than the actual overheads incurred in the period.

Flexing budgets and comparing the volume adjusted figures gives accurate variances but requires a good. If the actual expenses fall short of the amount applied there is said to be an over-absorption of overheads and conversely if the actual expenses exceed the amount applied to production it is a case of under-absorption. A Absorption rate 500000200000250.

The predetermined rates may represent estimated actual or normal costs.

Study Tips Fixed Overheads Part 2 Actual Overheads And Under Over Absorption Aat Comment

Overheads 1 Overheads Overhead Includes A Large Number

Ppt Overheads And Absorption Costing Powerpoint Presentation Free Download Id 467922

The Institute Of Chartered Accountants Of Sri Lanka

Study Tips Fixed Overheads Part 2 Actual Overheads And Under Over Absorption Aat Comment