Definition of Over-Absorption and Under-Absorption of Overheads. The term over absorption means that the amount of overhead absorption is more than theactual overhead is said to be over absorption of overhead.

Actual Data For Sap Controlling Sap Abap

1 00000 and the actual overheads incurred are Rs.

Over and under absorption of overheads in sap. Hi SAP Gurus Request for your help to resolve my following queries. Supplementary rate is calculated by dividing the amount of under or over-absorption by the actual base. Company A recovers its overheads based upon direct labor hours.

Easyquick way to find out underover absorbed overheadHow to calculate overhead costs for department. Over absorbed factory overheads. Reasons for Over or Under Recovery.

Viewing 2 posts - 1 through 2 of 2 total Author. What do you mean by over absorption. The term under absorption of overhead means that the amount of overhead absorption is lessthan the actual overhead incurred is said to be under absorption of overhead.

Also we calculate the overhead in costing sheet with plan rates. One of the causes may be overestimation of overheads used to calculate the absorption rate. If the amount of under or over-absorption is considerable.

Actual overheads being more than the estimated overheads The actual output is less than those estimated. Correction of overheads costs by a supplementary rate is nothing but recovering the overhead by actual rates. Since predetermined overhead rates are based on budgeted overheads and budgeted production invariably the overheads absorbed by this process do not agree with the actual overheads incurred for the period.

For example if the overheads absorbed on a predetermined basis are Rs. If the overheads absorbed on a predetermined basis are 10000 and the actual overheads incurred are 12000 there is under-absorption to the extent of 2000. The under absorption and over absorption of overhead.

OVER-absorption occurs when the total overhead recovered or absorbed is GREATER than the actual level of overheads for the period. Under-absorption under-recovery Overheads absorbed is LESS than Actually incurred. Usually overheads are absorbed on the basis of predetermined rates.

This allows to recalculate activity rate in order to achieve zero cost center balance. The process allows the total product cost to be used by the business in making decisions about pricing profitability and inventory valuations. If the overheads absorbed are lower than the actual overheads incurred during the accounting period it is called under absorption.

The use of a predetermined rate may therefore result in under-absorption or over-absorption. We normally book costs in service cost centers and then transfer these coste to production cost center. Under-absorption is set right by the plus rate while over-absorption is adjusted by minus rate.

This situation arises if the. Over-absorption of overheads means the excess of overheads absorbed over the actual amount of overheads incurred. If the actual amount of overhead turns out to be different from the standard amount of overhead then the overhead is said to be either under absorbed or over absorbed.

Disposition of over or under-applied manufacturing overhead. For this purpose it is necessary to perform appropriate settings of. If overhead is under absorbed this means that more actual overhead costs were incurred than expected with the difference being charged to expense as incurred.

This topic has 1 reply 2 voices and was last updated 9 years ago by. Overunder absorption of overheads. We calculate plan activity rates execute a costing run.

The difference between the absorbed and actual overheads incurred gives rise to an over or under absorption of overheads. If overhead is under absorbed this means that more actual overhead costs were incurred than expected with the difference being charged to expense as incurred. In case of under-absorption the cost of the job or product is increased by adding it to overheads charged on the basis of a positive supplementary rate and in case of over-absorption the cost of the job or product is decreased by deducting the extra amount of overheads charged by applying a negative supplementary rate.

The supplementary rate may also be calculated as a percentage of the amount absorbed. 1 20000 there is under-absorption to the extent of Rs20 000. At the end of the year the balance in manufacturing overhead account over or under-applied manufacturing overhead is disposed off by either allocating it among work in process finished goods and cost of goods sold accounts or transferring the entire amount to cost of goods sold account.

Forums ACCA Forums ACCA MA Management Accounting Forums Journal Ledger entries for Overunder absorbed overheads. Under-absorption is set right by the plus rate while over-absorption is adjusted by minus rate. The cost of job or process is adjusted by means of supplementary levy of the overhead.

Over-absorption over-recovery Overheads absorbed is MORE than Actually Incurred. Under-absorption of overheads means that the amount of overheads absorbed in the production is less than the amount of actual overheads-Incurred. If the overheads absorbed are higher than the actual overheads incurred it is called over absorption.

The other cause may be to under estimate the activity level or units of the cost driver. An over absorption arises where the absorbed overheads are more than the actual overheads incurred. Overheads absorbed OAR x actual level of activity.

The balance of cost center underover absorption can be allocated to the product using SAP functionality of revaluation at actual price. Over absorption arises when the amount absorbed is more than the actual overhead. When the amount absorbed is less than the actual overhead there is under-absorption.

UNDER-absorption occurs when the total overheads recovered or absorbed is LESS than the actual overheads incurred in the period. Overhead absorption is the name given to the process of absorbing the overhead of a business into the cost of its products. So when 100 are the costs incurred in service cost center and only 80 were transfered to production cost center there will be under absorption of 20 if 130 are transfered to production cost center then there is an over absorption of 30.

Overhead Cost Planning Using Costing Sheet Sap Blogs

Sap Make To Stock Cost Flow Erpcorp Sap Fico Blog

Sap Library Information System Co Om

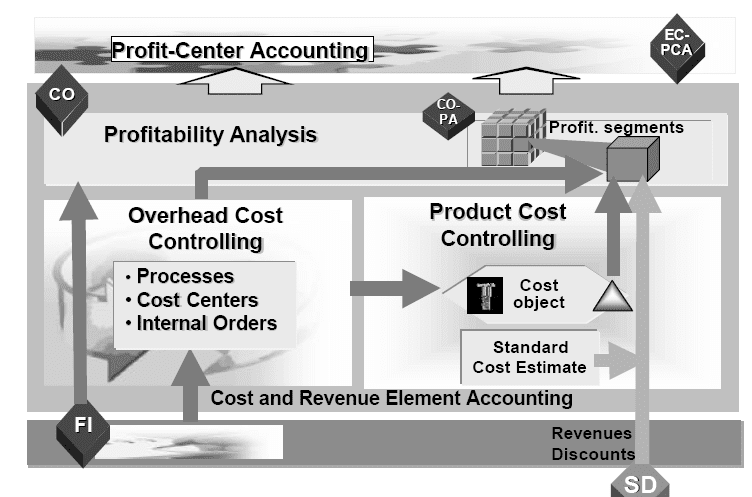

Sap Controlling Product Costing Part 1 Sap Blogs

Basics Of Standard Costing Understanding Overhead Cost Flow Part 4 Sap Blogs