For example the overheads recovered are 30000 and the actual production overheads are 27500 then there will be over-absorption of 2500. 1 20000 there is under-absorption to the extent of Rs20 000.

Chapter 8 Accounting For Overheads

Treatment of Over-absorption or Under-absorption in Cost Accounts.

Over under absorption example. Depending on the type of allocation desired some costs may be included in overhead and others may not. A Actual overheads cost 47000 and 25000. Administration overheads 32000 Production overheads 46500 Operating hours 90000 Production cost of sales 180000 What entries need to be.

The under absorption and over absorption of overhead. By employing data from diagram assume such the production overhead absorption rate was computed where an activity of two hundred machine hours was estimated. Company A recovers its overheads based upon direct labor hours.

Calculate the under-over-absorbed overhead and the reasons for the underover absorption in the following circumstances. Labour cost in primary cost element against cost center 1210 is Rs 5000. Easyquick way to find out underover absorbed overheadHow to calculate overhead costs for department.

Over-absorption of overheads means the excess of overheads absorbed over the actual amount of overheads incurred. Under absorption is an expense and will be transferred to the profit or loss account at period end either through the overunder absorption account or directly from overheads control account increasing the expenses and decreasing profit. This is a balancing figure and is transferred tothe Overunder-absorption of overheads account.

Methods for disposal of under or over-absorption of factory overheads. 4 At the end of an accounting periodthe balance on the overunder-absorption account is transferred to theincome statement where it is written off under-absorbed overhead orincreases profit over. And activity cost corresponding to that cost element is.

If overhead is under absorbed this means that more actual overhead costs were incurred than expected with the difference being charged to expense as incurred. Suppose in the above case the overheads recovered are Rs 3 48000 then there will be over-absorption of. The amount of work done may be substantially less or more than anticipated.

UNDER-absorption occurs when the total overheads recovered or absorbed is LESS than the actual overheads incurred in the period. Transfer to Costing Profit and Loss Account. What do you mean by over absorption.

Apportionment through supplementary rates. So system is showing over absorption of 12000 500025000-7000-35000. 1 00000 and the actual overheads incurred are Rs.

Actual data for one month was as follows. Such over or under-absorption may also be termed as overhead variance the amount of over-absorption being represented by the credit balance on the variance account and. Suppose actual production overheads are Rs 338000 and overheads recovered are Rs 324480 then there will be under-absorption of Rs 13520 ie.

The over or under absorption is the balance on the control account and may be posted to an overunder absorption account. Example of Over and under absorption of production overhead costs. I Rs240000 should be transferred to Costing Profit Loss Account as under- absorption has been caused by abnormal factors.

Under and over absorption of Overheads with example Cost Accounting Mathur Sir ClassesMathurSirClasses StudyMaterialPlease SUBSCRIBE for more videosMu. For example overhead absorption for a product would not include marketing costs but marketing costs might be included in an internal cost report for a distribution channel. Prepare a summary showing any over or beneath absorption of overhead cost whereas the real machine hours charged to jobs.

Reasons for Overhead Under Absorption and Over Absorption. Power cost in primary cost element against cost center 1210 is Rs 25000. For example if the overhead rate is predetermined to be 20 per direct labor hour consumed but the actual amount should have been 18 per hour then the 2 difference is considered to be over absorbed overhead.

Overhead absorption involves the following steps. Rs 338000 7 324480. For example if only 80000 hours of work are put in whereas the rate of absorption was fixed on the basis of 100000 hours the amount of expenses charged to jobs will be 20 per cent less.

If the actual expenses fall short of the amount applied there is said to be an over-absorption of overheads and conversely if the actual expenses exceed the amount applied to production it is a case of under-absorption. Power 35000 Rs. Under-absorption of overheads means that the amount of overheads absorbed in the production is less than the amount of actual overheads-Incurred.

OVER-absorption occurs when the total overhead recovered or absorbed is GREATER than the actual level of overheads for the period. A credit balancingamount is an over-absorption and a debit balancing amount is anunder-absorption. The under-over-absorbed overhead account Mariotts Motorcycles absorbs production overheads at the rate of 050 per operating hour and administration overheads at 20 of the production cost of sales.

For example if the overheads absorbed on a predetermined basis are Rs. For example if the overheads absorbed on a predetermined basis are Rs. Ii Rs160000 should be charged to units produced.

Disposition of over or under-applied manufacturing overhead. Reasons for under-over-absorbed overhead Pembridge Co has a budgeted production overhead of 50000 and a budgeted activity of 25000 direct labour hours and therefore a recovery rate of 2 per direct labour hour. Under-absorption of overheads means that the amount of overheads absorbed in the production is less than the amount of actual overheads-Incurred.

Over and under-absorption for the period are transferred to the income statement statement of profit for that period as either income or an expense respectively Example The following data relates to Benzi Ltd for period ended 31 December 208. At the end of the year the balance in manufacturing overhead account over or under-applied manufacturing overhead is disposed off by either allocating it among work in process finished goods and cost of goods sold accounts or transferring the entire amount to cost of goods sold account. 1 00000 and the actual overheads incurred are Rs.

Chapter 8 Accounting For Overheads

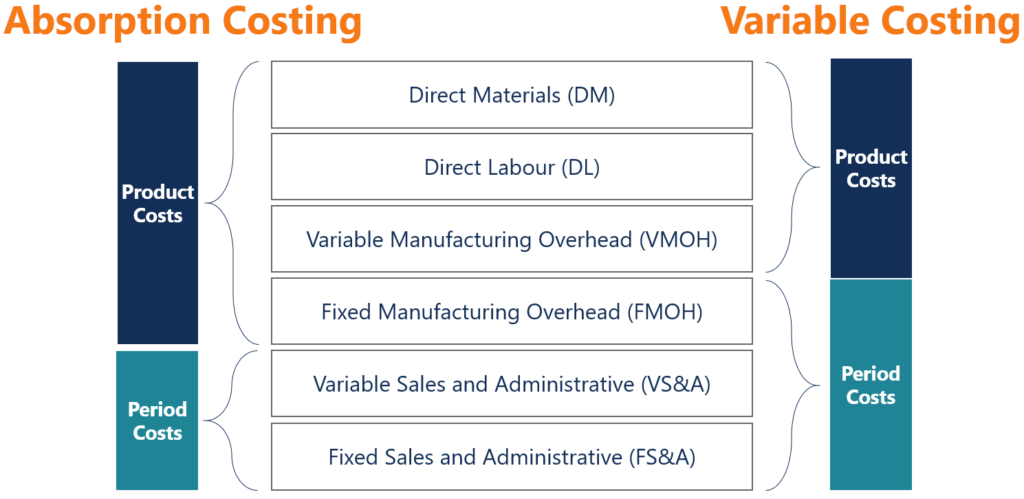

Absorption Costing How To Use The Full Costing Method Guide

Peanut Butter Costing Meaning Example Drawbacks And More In 2021 Learn Accounting Bookkeeping Business Economics Lessons

Calculation Of Overhead Absorption Rate Formula Methods Solved Example

Absorption Costing Formula Calculation Of Absorption Costing